why we build SatSwap

A new narrative chapter for the Bitcoin network is about to begin

We built a platform for

The Bitcoin network

The platform consists of 3 parts Bitcoin swap-ORC20/BRC20 Bitcoin bridge ORC20/BRC20-ERC20 Bitcoin lightning

We hope that more defi applications can be carried out through the Bitcoin network, so that more financial services can be decentralized to the greatest extent

We will substitute a more convenient exchange method into the Bitcoin network

ORC20/BRC20 Swap

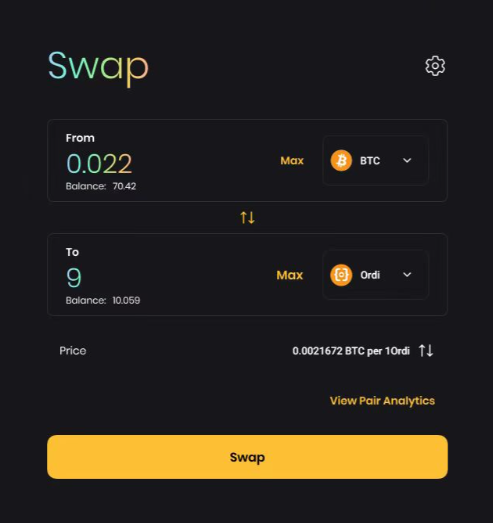

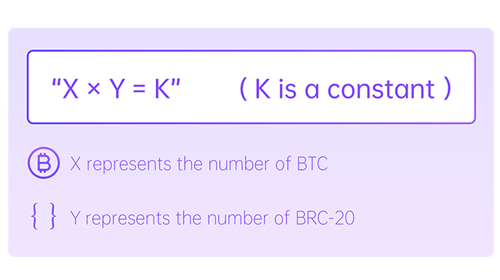

Price

The x and y tokens represent the quantity of the two tokens, that is, the BRC20 quantity and the BTC quantity

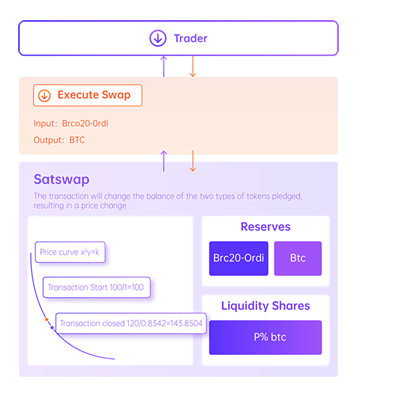

Trade

1. Enter BRC20, or deduct the handling fee 2 Calculate according to the formula of x*y=k (k=1*100=100) 3. After buying 120 BRC20, 1Y=100x, (20/100=0.2btc) –(20/100=0.2btc)*0.3%≈0.17 4. Update the balance in the liquidity pool. Although a 0.3% handling fee is deducted during the transaction, with the accumulation of transaction handling fees, the total value of the entire liquidity pool is rising, and the total amount of LPS remains unchanged, so the LPS unit value increased. There are 2 ways to handle the handling fee A: Mapping Decomposition BRC20 B: Through calculation, included in the buyer's Btc

Increase and Decrease

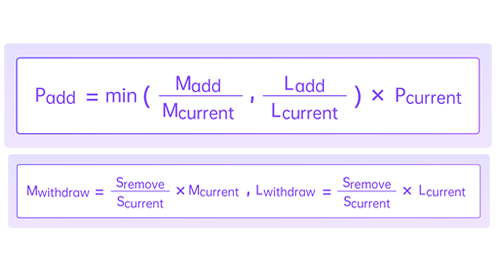

Regarding the increase in liquidity, it is to increase the issuance of LPS in equal proportions. Assume that the amount of brc20 in the current Pool is M_c, the amount of btc is L_current, and the stock LPS is P_c. m_c/l_c = m_add/l_add, that is, increase liquidity in equal proportions Regarding the reduction of liquidity, it is to reduce LPS to s_r, brc20 to x_c, btc to y_c, and LPS to s_c, then the two types of tokens that LP can withdraw are mdw and lwd

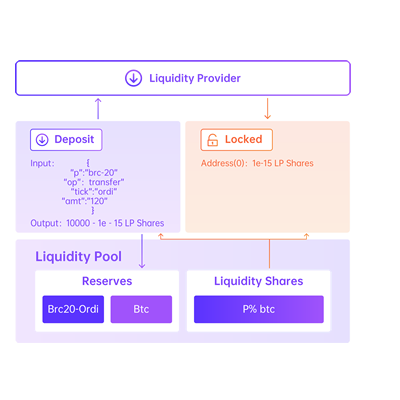

Liquidity

LP will increase liquidity according to the ratio of brc20 and btc in the current liquidity pool, obtain LPS, and complete the operation of increasing liquidity through peripheral auxiliary contracts or Lightning Network. The pool is different, it will be pledged according to the proportion of the less tokens, and the other will not be pledged to avoid double spending and losses.

Bridge

Regarding the implementation of the bridge, we need to realize the reception of erc20 token through the EVM contract, and its price follows the Time-Weighted Average Price. When the erc20 token is received and the price is obtained, the BTC price is pulled up to realize the conversion according to the exchange rate. Both parties do not need to operate across chains, and the process will be completely decentralized. reduce human intervention

In order to avoid evil and extreme situations, we will access chainlink and other oracle machines to avoid price manipulation

Token Distribution

Donate & Airdrop

Details

SatSwap is a project hatched by the $Ordi and $Vmpx communities with the goal of improving the poor infrastructure of BRC20/ORC20 and introducing external mobility to the BTC ecology. The project inherited the spirit core of Ordinals, the project token fair launch, all tokens belong to the community, there is no institutional investment, the development team does not retain the token share, project development depends on donations, the community provides 30% of the token airdrop for donors. The remaining 35% tokens are used to provide liquidity incentive for swap pool, and 35% belong to SatDAO to support the sustainable development of the project.

Donations will open at Bitcoin Pizza Festival (May 22 UTC12:00/EDT8:00)